Investor Readiness: Accelerate Your Funding with Confidence

Show Investors You're Audit-Ready, Funding-Ready, Future-Ready.

Investors don't just fund ideas. They fund trust.

With Block Convey's Investor Readiness reports, you show VCs and angels that your AI models are transparent, compliant, and where you would invest the money.

Get Your Investor Readiness Report

Why Investor Readiness Matters

Funding Faster

Cut due diligence time by up to 60% with pre-built compliance and risk insights.

Data-Backed Confidence

Demonstrate performance, fairness, and governance metrics that investors demand.

Valuation Booster

Highlight improvements between pre- and post-investment model versions.

Strategic Investment

Where the investment will go and why that improvement is needed for better sales.

What's Inside an Investor Readiness Report

Performance Benchmarks

Clear ranges showing where your AI stands today (e.g., 'Model Accuracy: 88% - Within Optimal Range').

ROI Scenarios

Example: 'Improving accuracy by 1% could approve 5 more customers in a 500-person dataset = more revenue potential.'

Compliance Mapping

Evidence your model aligns with AI regulations (NIST, ISO, EU AI Act).

Risk Indicators

Identify overtraining, bias, and gaps investors should factor into scaling plans.

Improvement Pathway

Pre- and post-investment roadmap showcasing how new funding translates into model performance.

How It Works

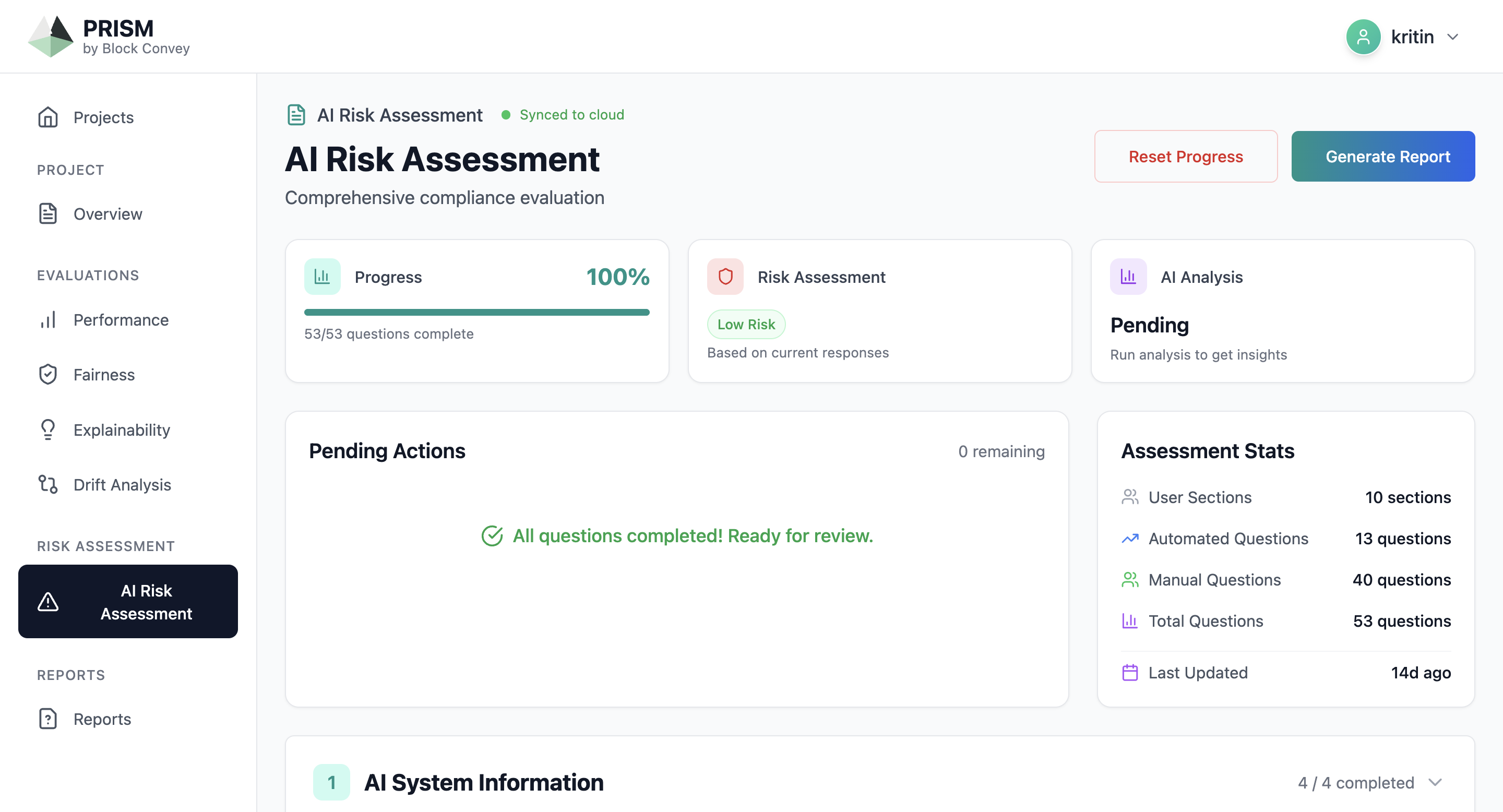

Evaluate

We run your model through Block Convey's AI governance engine.

Score

Generate risk, compliance, and performance scores investors can trust.

Report

Deliver a PDF dashboard tailored for investors, easy to share in boardrooms or pitch decks.

Plan

Outline the 'use of funds' tied directly to AI risk & performance improvements.

Why Investors Love It

Pre-Investment

Spot weak areas early and justify why funding is needed.

Post-Investment

Show measurable improvements in fairness, performance, and readiness.

Comparative Edge

Stand out from competitors by proving AI is responsibly managed.

Case Study Scenario

Fintech KYC Model

Pre-Investment

Model accuracy = 88% (optimal but improvable).

Investor Insight

Each 1% accuracy gain could approve 5 more customers per 500 applications, unlocking more revenue.

Post-Investment

Accuracy improved to 91% with bias reduced by 12%.

Outcome

Faster approvals, higher compliance score, and investor confidence in scalability.